unrealized capital gains tax canada

In Canada 50 of your capital gain is. Regardless of whether or not the sale of a capital property results in a capital gain or loss you have to file an income tax and benefit return to report the transaction even if you do not have.

Understand Taxes For Investing A Guide For Canadian Beginners Wealthy Corner

For example if you buy a house for 200000 and the value goes up to 210000 your basis is 200000 and you have a 10000 unrealized gain.

. Instead when you incur a capital gain in Canada 50 of the capital gain is taxable. One of the most common questions we receive from Americans. Because you only include onehalf of the capital gains from these properties in your taxable.

Do you have to report unrealized gains Canada. In Canada 50 of the value of any capital gains is taxable. Deduct this ACB from the sale price.

High-income people also pay an additional 38 percent tax to fund health care on both earned income and investment income like capital gains so including that the top rates are 238 percent for capital gains and 408. If you decide to sell youd now have 14 in realized capital gains. The capital gains inclusion rate is 50 in Canada which means that you have to include 50 of your capital gains as income on your tax return.

Unrealized gains and losses occur any time a capital asset you own changes value from your basis which is usually the amount you paid for the asset. When investors in Canada sell capital property for more than they paid for it Canada Revenue Agency CRA applies a tax on half 50 of the capital gain amount. In our example you would have to include 1325 2650 x 50 in your income.

Multiply 5000 by the tax rate listed according to your annual income minus any selling costs. The price could change before. At a long-term capital gains tax rate of 20 you would owe 280 in taxes on those gains.

If the value drops to 190000 you have a 10000 unrealized loss. Capital gains meaning earnings from selling an asset for more than you bought it are taxable under federal tax law. Under current law the top income tax rate for capital gains is 20 percent while the top income tax rate for other types of income is 37 percent.

7950 2400 5550. The good news is you only pay tax. The amount of tax youll pay depends on how.

If the equity investment value increases you must pay capital gains tax. The inclusion rate for personal and business income is 100 meaning you need to pay taxes on all of your income. Do you pay tax on unrealized gains Canada.

An unrealized capital gain occurs when your investments increase in value but you havent sold them. This amount is included in your income the year you incurred the capital gain. There is no unrealized gain tax so you wont report unrealized gains or losses on your tax filings.

As mentioned youre required to pay tax on realized capital gains. The capital gains tax only applies to realized capital. American citizens living in Canada for more than five years face an imposed exit tax on unrealized gains.

If you earned a capital gain of 10000 on an investment 5000 of that is taxable. For dispositions of qualified farm or fishing property QFFP in 2021 the LCGE is 1000000. Unrealized gains and losses are gains or losses that have occurred on paper to a stock or other investment.

A stock or piece. Capital gains are in two categories. This means you have a capital gain because its more than your ACB.

Unfortunately there isnt a specific tax rate for capital gains. A capital gains tax is a levy on the profit that an investor makes from the sale of. To increase their effective tax rate to 20 percent the household must remit an additional 12 million in tax 3 million in taxes paid with a 15 million income inclusive of unrealized gains.

When including unrealized capital gains as income the households effective tax rate is 12 percent below the proposed 20 percent minimum. If you also have a capital loss you can offset the capital gain amount. As the rules are currently written only 50 of a capital gain is subject to tax in Canada.

Under Canadian income tax law gains or losses on income account are fully included.

Individuals Pay Very Little Individual Income Tax On Capital Income Tax Policy Center

Capital Gains Tax In Canada Explained

What Is Unrealized Gain Or Loss And Is It Taxed

Tax Increases Are Coming Or Are They Bny Mellon Wealth Management

Why Borrowing Is An Investment Decision Bny Mellon Wealth Management

Capital Gains Tax Canada Explained

Janet Yellen S Idea To Tax Unrealized Capital Gains R Wallstreetbets

Key Differences Between Canada And Us Tax Capital Gains Venture Cfo

How Capital Gains Tax Works In Canada Forbes Advisor Canada

Opinion Avoiding Biden S Proposed Capital Gains Tax Hikes Won T Be So Easy Or Will It Marketwatch

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget

Senate Democrats Push For Capital Gains Tax At Death With 1 Million Exemption Wsj

Capital Gains Tax In Canada 2022 50 Rule Fully Explained

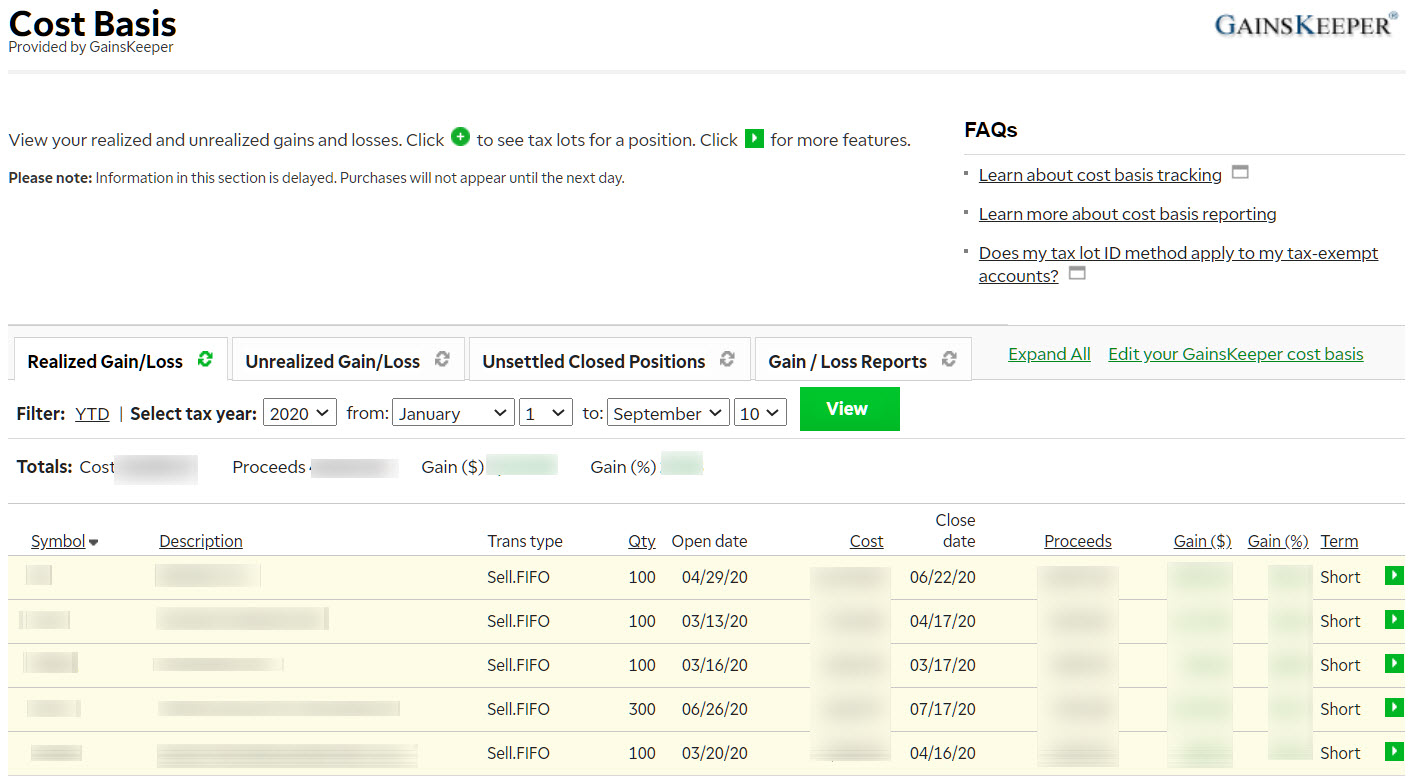

Cost Basis Capital Gains Losses And Mythical Beings Ticker Tape

Democrats Weigh A Tax On Billionaires Unrealized Capital Gains The New York Times

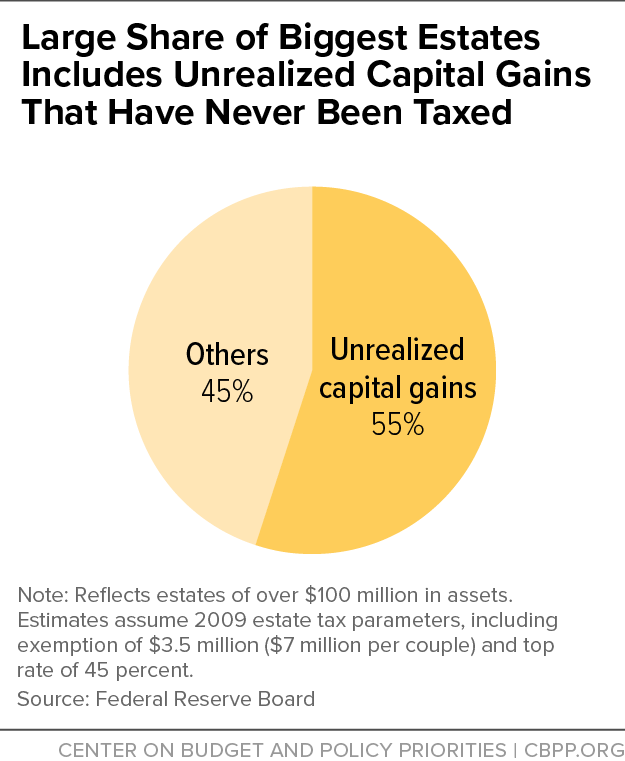

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities